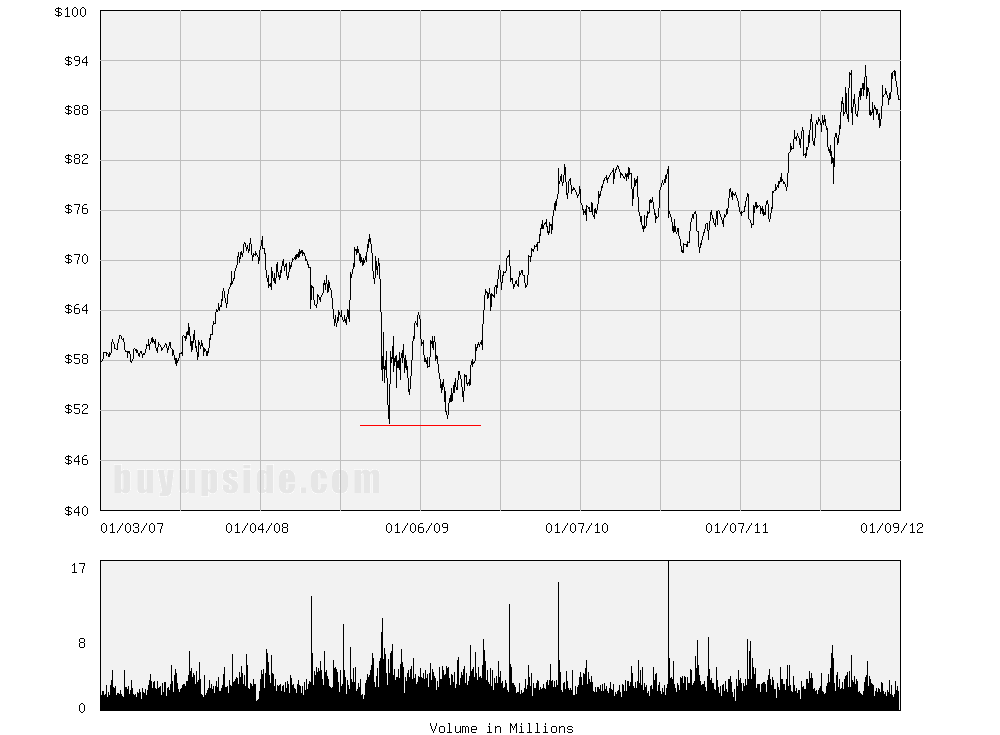

Bottoming Price Pattern - Double Bottom

A double bottom is a frequently observed bottoming formation that occurs when a bottom is followed by a short-term upside and then a short-term downside that culminates with a second bottom. The second bottom reaches approximately the same price value as the first bottom and is followed by a significant upside.

Below is a double bottom chart of daily closes for Colgate-Palmolive (CL). The red horizontal line is the support level for the two bottoms.

Related Articles

Introduction to Stock Price Patterns

Bottoming Price Pattern - Reverse Head and Shoulders

Topping Price Pattern - Bubble Top

Topping Price Pattern - Double Top